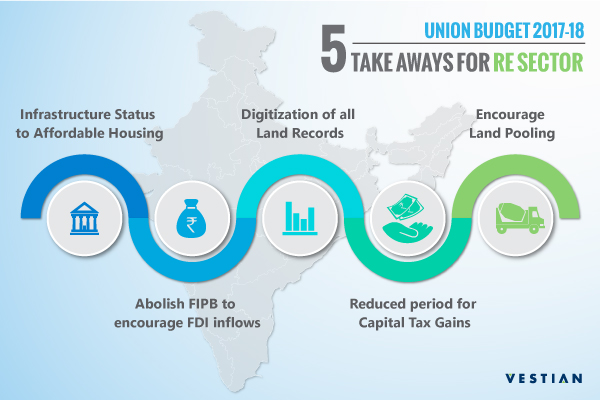

In a quest to increase transparency & accountability, the Union Budget 2017-18 outlined several pro-poor, pro-agriculture, pro-infrastructure initiatives today. While inclusion of Railways, Civil aviation and Water transport was anticipated to be categorized under “Infrastructure”, interestingly FM also considered “Affordable Housing” under his commitment to drive promising infrastructure in our country. Although “industry status” was not bestowed onto the real estate sector, the Union Budget 2017-18 listed several measures to improve transparency and accountability in real estate in India.

Infrastructure status for Affordable Housing

Granting “Affordable Housing” infrastructure status, apart from making funds easily available for financing affordable housing projects, will also encourage private players to make investments in this segment. This would result in competition, which will work towards the better options for the middle-class and lower-middle class aiming to buy their first homes. Since the country’s banking system is set to support this initiative by lowering lending rates even further, it will drive demand in rural & urban markets in the short to medium term. This move can be anticipated to ease the present inventory pile up situation across Tier 1 cities to some extent.

Shorter period Capital Tax gains

FM categorically mentioned the period of long term capital gains has been shortened from 3 years to 2 years. This will boost residential sales and also help in the realisation of the Government’s pledge of “Housing for All by 2022” initiative.

Digitization of all Land records

Land Ownership challenges have long plagued this country and led to a substantial increase in the number of litigation cases across the country. Digitization of land records is a progressive move towards better governance. This is also a step by the government towards launching a centralised system that would automatically reduce the litigation on title thereby enhancing the speed at which properties would be transacted in the country.

Removal of FIPB

Abolishing the Foreign Investment Promotion Board (FIPB) will provide the necessary impetus for FDI inflows across industries. India witnessed a 36% increase in FDI inflows during the financial year 2016-17, of which FDI in real estate recorded about 7% growth at USD 141 million. The government’s initiative towards liberation of the current FDI policy is a prudent move post Demonetization drive launched last November. Introduction of the BHEEM Mobile App and strengthening of the country’s present digital infrastructure are sure to increase investor confidence towards transparent transactions.

Encourage Land Pooling

Land Pooling strategy adopted to create the new Andhra Pradesh capital city was illustrated as a viable model for India’s Smart Cities and for upgrading Tier 2 cities across India. A suitable alternative to forcible land acquisition, this voluntary movement encourages PPP participation. Since the ownership rights are now handed over to a single agency/ government body- the original land owner is guaranteed of credible institution for property development & better future returns although the initial compensation amount may seem low.

Additionally, the government has proposed to construct 1 crore houses for the homeless by 2019 and the PM’s Awas Yojana allocation has been raised to Rs 23,000 crore, from Rs 15,000 crore. These initiatives will certainly make “Housing for All by 2022” a reality in India. Real estate contributes to 15% of the country’s GDP- and relaxation in tax rates, necessary policy amendments are vital to ensure the government’s promise of a better infrastructure, better governance and smarter cities. While the Union Budget 2017-18 didn’t factor in simplified tax norms for REITs or raise House Rent Allowance (HRA) deduction to boost home loans- it has favoured first time home buyers and ensured the presence of a “concrete” roof for all.